For thousands of years, humanity’s concept of money has evolved from shiny metal coins passed from hand to hand, to printed paper bills guarded in wallets, to numbers glowing faintly on computer screens. Yet in the early 21st century, an even more profound transformation began — one that could redefine the meaning of money itself. This was the birth and rise of digital currency: value that exists purely in electronic form, moving through invisible channels, governed not by tradition alone but by mathematics, cryptography, and networks.

Digital currency is not merely a new payment method. It is a revolution that challenges the role of banks, redefines trust, and raises profound questions about privacy, power, and the very structure of the global economy.

From Shells to Code: The Long Road to Digital Value

To understand the radical nature of digital currency, we must journey back through time. Money has always been a human invention, an agreement between people about what holds value. In ancient societies, seashells, salt, beads, or cattle could serve as currency. Later, precious metals like gold and silver became the dominant standard, their rarity and physical properties giving them an aura of permanence.

The next leap was paper money, first pioneered in China during the Tang Dynasty and later embraced by Europe. Then came the modern banking system, which digitized money’s representation in the form of account balances stored in computers. Even before cryptocurrencies existed, much of the world’s money was already electronic, transferred between banks and institutions through databases and networks.

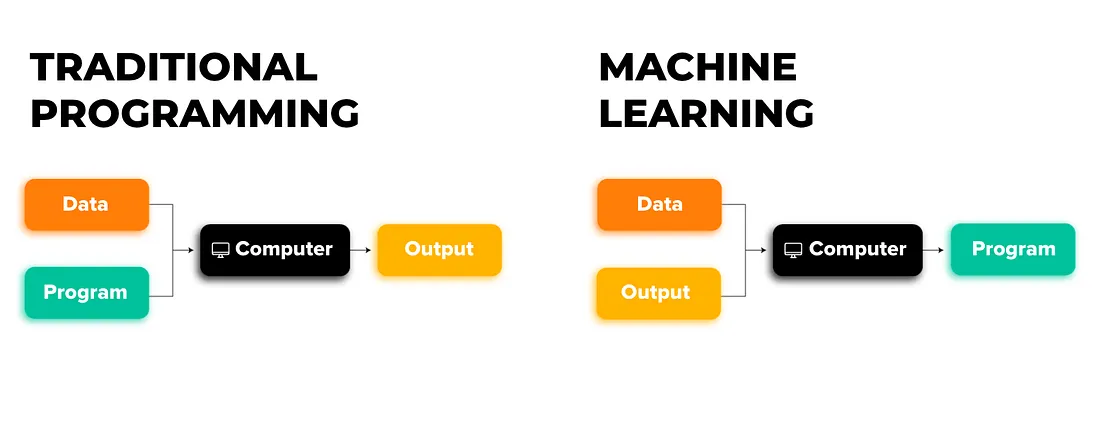

But there was a difference: traditional digital money still relied on centralized authorities — banks, governments, clearinghouses — to verify transactions. Digital currency as we know it today seeks to change that by introducing systems where trust is distributed, cryptographically secured, and independent of a single controlling entity.

The Dawn of Decentralization

The true spark for the modern digital currency movement came in 2008, during a time of economic crisis. A mysterious figure using the name Satoshi Nakamoto published a nine-page white paper titled Bitcoin: A Peer-to-Peer Electronic Cash System. The paper outlined a radical idea: a way for people to send money to each other directly over the internet without going through a bank, using a network of computers to collectively verify transactions.

At the heart of Bitcoin was blockchain technology — a decentralized ledger that records every transaction in a chain of blocks linked by cryptographic proofs. Once recorded, the data in these blocks cannot be easily altered. Trust was no longer placed in an institution but in a mathematical process and a network consensus.

When the Bitcoin network went live in January 2009, few could have predicted how far this idea would spread. From a niche experiment among cryptographers and technophiles, Bitcoin grew into a global financial phenomenon, inspiring thousands of other digital currencies — from Ethereum to stablecoins like USDC, and even national initiatives exploring central bank digital currencies (CBDCs).

The Anatomy of Digital Currency

What makes digital currency so revolutionary is not just that it is electronic — after all, online bank transfers have existed for decades — but how it is managed and secured. There are several key aspects:

First, digital scarcity. In the physical world, scarcity is natural; gold is rare because the Earth holds a limited amount of it. In the digital realm, scarcity must be engineered. Bitcoin’s code dictates that there will never be more than 21 million coins. This artificial limit mimics the scarcity of precious metals, giving the currency a predictable supply.

Second, cryptographic security. Digital currencies rely on advanced encryption to protect transactions and ownership. In cryptocurrencies, a public key acts as an address for receiving funds, while a private key allows spending them. The private key must be guarded with absolute care — lose it, and your funds are gone forever.

Third, decentralized consensus. Instead of a single bank keeping track of everyone’s balance, thousands of computers worldwide run the same software, agreeing on which transactions are valid. This agreement is reached through mechanisms like Proof of Work (as in Bitcoin) or Proof of Stake (as in Ethereum’s newer system).

Fourth, borderless nature. Digital currencies are not confined by national borders or traditional banking hours. A transaction can move from one side of the planet to the other in minutes, sometimes seconds, without the permission of any government or bank.

Beyond Bitcoin: The Expanding Universe

Bitcoin may have been the pioneer, but it did not remain alone for long. The concept of blockchain opened the door for a vast ecosystem of digital currencies and tokens, each with its own vision and purpose.

Ethereum, launched in 2015 by Vitalik Buterin and others, expanded the idea beyond simple money transfers. It introduced smart contracts — self-executing agreements encoded directly on the blockchain. This allowed the creation of decentralized applications (dApps) and decentralized finance (DeFi) systems, where lending, trading, and investing could happen without banks or brokers.

Other projects focused on privacy, like Monero and Zcash, offering ways to make transactions untraceable. Some aimed for speed and scalability, like Solana or Avalanche. Stablecoins emerged as digital currencies pegged to traditional money, aiming to combine the efficiency of blockchain with the stability of fiat currency.

The Promise and the Peril

Digital currency carries a sense of liberation. For the unbanked — nearly 1.4 billion people worldwide without access to traditional banking — it offers a way to store and transfer value using just a smartphone. For migrants sending remittances, it can bypass expensive middlemen. For those living under oppressive regimes, it can be a lifeline for financial freedom.

Yet this freedom comes with risk. The same decentralization that removes reliance on banks also removes a safety net. If you lose your private keys, your money is unrecoverable. If you send funds to the wrong address, there is no bank to reverse the transaction.

Moreover, digital currencies have attracted criminal use — from ransomware to illicit markets — because of their pseudonymous nature. Governments struggle to balance innovation with regulation, wary of both money laundering and the erosion of their control over national currencies.

The Rise of Central Bank Digital Currencies

Ironically, the decentralized revolution has pushed central banks to explore their own form of digital money. Central Bank Digital Currencies (CBDCs) aim to combine the efficiency of digital currency with the stability and legal authority of state-issued money. China’s digital yuan is one of the most advanced examples, already used in pilot programs across cities.

A CBDC is not a cryptocurrency in the Bitcoin sense — it is fully centralized, controlled by the issuing central bank. Yet it could make payments faster, cheaper, and more accessible, potentially replacing cash entirely in some countries. Critics warn, however, that it could also enable unprecedented government surveillance of every transaction.

Digital Currency in the Cultural Imagination

The rise of digital currency has sparked fascination far beyond the financial world. It has become a cultural phenomenon, inspiring films, novels, memes, and an entire aesthetic of futurism and digital rebellion. Early adopters saw themselves as pioneers in a new frontier, challenging centuries-old institutions.

At the same time, speculative booms and busts — from Bitcoin’s surge to $69,000 in late 2021 to its crashes — have made headlines worldwide, fueling both dreams of instant wealth and tales of crushing loss. The volatility has been both a magnet for traders and a source of skepticism for traditional economists.

The Environmental Debate

No discussion of digital currency is complete without addressing the environmental cost. Bitcoin’s Proof of Work system, in particular, consumes enormous amounts of electricity, as miners compete to solve cryptographic puzzles. Estimates have placed its energy usage on par with that of entire nations.

Supporters argue that mining can incentivize renewable energy and make use of surplus power, while critics see it as a wasteful arms race. The debate has spurred many projects to adopt more energy-efficient methods, such as Proof of Stake, which drastically reduces consumption.

The Next Decade: Integration or Revolution?

As we move deeper into the 2020s, digital currency stands at a crossroads. Will it become seamlessly integrated into the existing financial system, with banks, governments, and corporations adopting blockchain under regulated frameworks? Or will it remain a parallel economy — decentralized, borderless, and resistant to control?

Some envision a hybrid future, where CBDCs coexist with decentralized cryptocurrencies, each serving different needs. Others see potential in tokenizing assets — turning everything from stocks to real estate into blockchain-based tokens that can be traded instantly around the world.

The Human Element: Trust in the Age of Code

Beneath all the technology, digital currency ultimately comes down to trust. In the past, we trusted kings, banks, or paper backed by gold. In the digital era, we are asked to trust algorithms, networks, and cryptographic proofs. For some, this is liberating — mathematics cannot lie, and code cannot be bribed. For others, it feels alien, replacing the human element with something cold and mechanical.

Yet perhaps the story of digital currency is less about replacing trust than about redistributing it. Instead of concentrating power in a few hands, it spreads it across a network. Instead of trusting an institution to be honest, it builds honesty into the very structure of the system.

Conclusion: The Currency of Tomorrow

Digital currency is more than a technological innovation. It is a philosophical challenge to our assumptions about money, authority, and value. It is a tool that can empower individuals or entrench control, depending on how it is shaped and governed. It is a reminder that money has always been a story we tell ourselves — a shared belief that something has worth because we agree it does.

In this unfolding chapter of human history, we stand at the edge of a transformation as significant as the invention of coinage or paper money. The lines between physical and digital, local and global, centralized and decentralized are blurring. And while no one can predict exactly what form money will take in the decades ahead, one thing is certain: the idea that value can live entirely in the realm of code has already changed the world — and there is no turning back.