In the autumn of 2008, as the world grappled with the tremors of a financial crisis, a quiet ripple began in a corner of the internet. An individual — or perhaps a group — under the mysterious name Satoshi Nakamoto released a white paper describing a new kind of money: Bitcoin. It wasn’t just a currency. It was a declaration of independence from the centralized systems that had long dominated human exchange.

At the heart of Bitcoin was a concept few had heard of before: blockchain technology. At first glance, the word sounded almost mechanical, as if it belonged in a factory manual. But behind the name was a profound idea — one that would soon ripple far beyond finance, reaching into law, healthcare, art, and even the way we think about truth itself.

Blockchain was not merely a tool for sending money. It was a way to create trust without intermediaries, to store information so securely and transparently that no one could secretly change it. That promise has fueled a technological revolution, and to understand it is to glimpse a future still unfolding.

The Anatomy of Trust in the Digital Age

Trust is as old as humanity itself. Villages once relied on personal bonds, where reputation was built over years of shared harvests and meals. As societies expanded, trust needed new scaffolding — kings, courts, banks, and eventually entire bureaucracies arose to guarantee that promises were kept and records remained true.

But the digital age changed the pace of life. Transactions no longer happened across a table but across continents in milliseconds. The old guardians of trust — banks, governments, and corporations — became both indispensable and, in the eyes of many, uncomfortably powerful.

Blockchain’s bold proposal was to remove these centralized arbiters and replace them with a system where trust was not placed in a person or institution, but in mathematics. In a blockchain, there is no single vault to guard, no central bookkeeper to bribe or coerce. Instead, every participant in the network becomes a witness to the same shared record, and altering that record becomes almost impossibly difficult.

The Chain and Its Blocks

To imagine a blockchain, picture a series of digital “pages” — each one called a block — containing records of transactions. Once a block is filled, it is linked to the previous one, creating a chain of blocks. This chain grows over time, and each link strengthens the integrity of the whole.

What makes this structure extraordinary is the way each block is locked to the one before it. A special fingerprint, known as a cryptographic hash, seals each block. If someone tries to change even the tiniest detail inside a block, the fingerprint changes instantly — and the entire chain recognizes the tampering. It’s like trying to sneak a forged page into a book where every page has been uniquely stamped and verified by every reader in the world.

This design makes blockchain not only secure but immutable — once information is recorded, it cannot be erased or rewritten without everyone noticing.

The Power of Decentralization

In most traditional systems, power is centralized. A bank keeps its ledger behind secure doors; a government keeps land records in its archives. If those doors are broken or those archives are corrupted, trust collapses.

Blockchain turns that model inside out. Instead of a single authority holding the master copy, every participant holds their own copy of the entire chain. These copies are synchronized through a set of rules called a consensus mechanism, which ensures everyone agrees on the current state of the ledger.

This decentralization has profound implications. It means that even if part of the network is attacked, fails, or is taken over, the system as a whole remains intact. There is no single point of failure, no single entity with unchecked control. It is, in essence, power distributed into the hands of many rather than the few.

Mining, Proof, and the Birth of New Blocks

The process of adding new blocks to the chain is not casual. It is the beating heart of blockchain’s trust. In Bitcoin, this process is called mining, though no pickaxes or caves are involved. Instead, computers race to solve complex mathematical puzzles. The first to solve it earns the right to add a new block to the chain and receives newly minted coins as a reward.

This system, known as Proof of Work, demands immense computational effort, which makes it extremely costly for anyone to try and tamper with the chain. To rewrite the blockchain, an attacker would need to redo the work of not just one block but every block after it — across a majority of the network — an almost impossible feat.

Other blockchains use different methods, like Proof of Stake, where participants lock up their own coins as a kind of security deposit to prove they will act honestly. Regardless of the method, the goal is the same: to make cheating far more expensive than playing fair.

Beyond Bitcoin: The Blockchain Expands

While Bitcoin introduced the world to blockchain, it was Ethereum that revealed its broader potential. Launched in 2015 by a young programmer named Vitalik Buterin, Ethereum added the ability to run smart contracts — self-executing agreements coded into the blockchain.

A smart contract is like a vending machine: if you put in the right input, the machine automatically delivers the output, without human involvement. On a blockchain, this means that once the rules are set, they cannot be altered midstream, and everyone can see that they were followed exactly.

This capability opened a floodgate of innovation. Suddenly, developers could build decentralized applications — or dApps — for everything from lending money to trading digital art.

The Human Stories Behind the Code

It’s easy to lose sight of the fact that blockchain, for all its cryptography and code, is a human invention shaped by human hopes and fears. Behind every protocol is a philosophy. For some, blockchain is about freedom — the ability to transact without permission from a bank or government. For others, it’s about transparency, ensuring that no single entity can quietly change the rules.

But blockchain’s rise has also been marked by greed, speculation, and hype. Fortunes have been made and lost in volatile markets. Scams and poorly designed projects have tarnished the reputation of the space. These human flaws remind us that no technology is inherently good or bad; it reflects the intentions of those who wield it.

The Problem of Scale and Energy

Blockchain is not without its critics, and their concerns are real. In Bitcoin’s Proof of Work system, the race to solve puzzles consumes vast amounts of electricity. Critics argue that this environmental cost is too high, especially in a warming world.

Others point to scalability: Bitcoin processes only a handful of transactions per second, far less than the thousands handled by traditional payment networks like Visa. For blockchain to achieve global adoption, it must find ways to grow without losing the very security that makes it trustworthy.

Innovations are underway — from more efficient consensus mechanisms to “layer 2” solutions that process transactions off the main chain — but the balance between speed, security, and decentralization remains a delicate dance.

Blockchain in the Real World

Today, blockchain has moved far beyond the shadow of cryptocurrencies. In healthcare, it is being used to create secure, shareable patient records that can travel with individuals across borders. In supply chains, it tracks goods from origin to destination, ensuring authenticity and ethical sourcing. In voting systems, it offers the promise of tamper-proof elections.

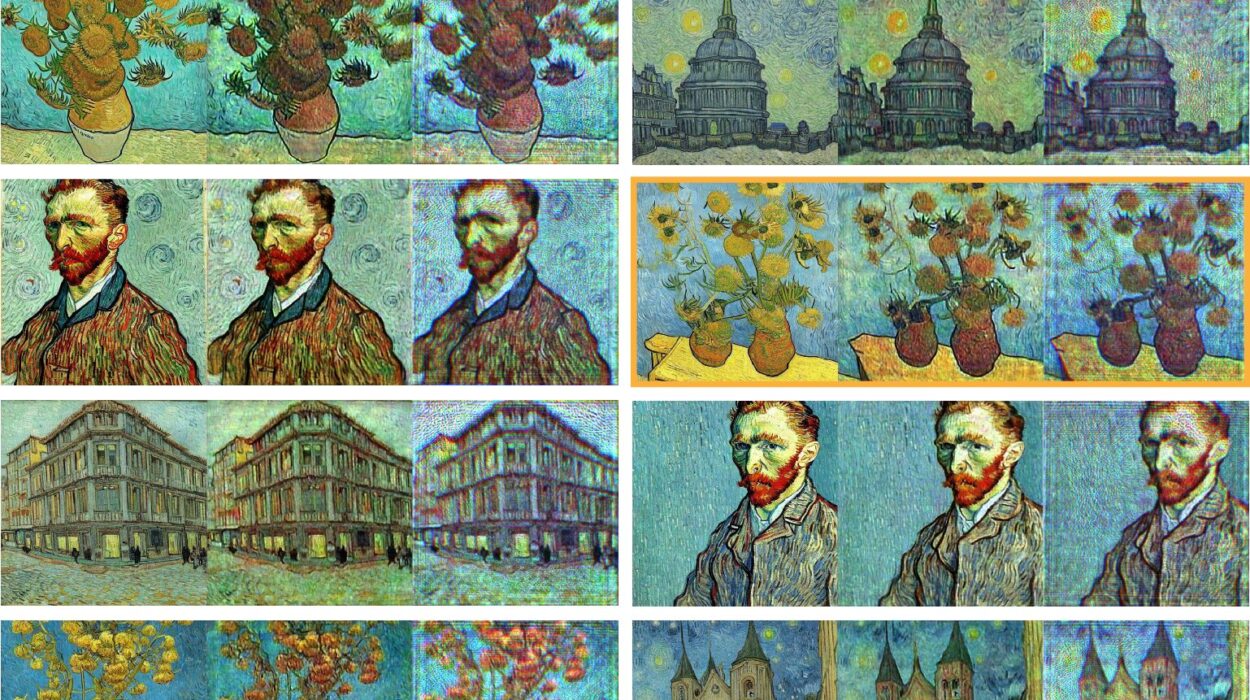

Even the art world has felt blockchain’s touch through NFTs — non-fungible tokens — which allow digital art to be bought, sold, and owned with a verifiable chain of custody. While NFTs have sparked both excitement and skepticism, they have undeniably changed the conversation about ownership in the digital realm.

The Philosophy of an Immutable Ledger

There is something almost poetic about blockchain’s central promise: a record that cannot be erased. In a world where information can be manipulated, deleted, or rewritten, the blockchain stands as a stubborn witness.

For societies wrestling with questions of truth — in media, in history, in governance — this immutability offers both comfort and caution. Comfort, because it creates a space where lies cannot hide. Caution, because once recorded, even mistakes remain forever. The blockchain forgets nothing.

Looking Ahead: A Technology in Adolescence

Blockchain today is like the internet in the early 1990s — full of potential but still rough around the edges. The pioneers are building roads through an unexplored landscape, knowing that not every path will lead somewhere useful.

Some dream of a fully decentralized web where users control their own data and identities, breaking free from corporate monopolies. Others envision global financial systems where remittances can be sent instantly without crushing fees. Still others see blockchain as the backbone of a new kind of digital nation, unbound by geography.

The truth is, no one knows exactly where this technology will take us. But its core idea — that we can create trust through code, shared by all and owned by none — is not going away.

Conclusion: The Chain We Are Building Together

To understand blockchain is to see more than just cryptographic hashes and consensus algorithms. It is to see a collective experiment in reimagining trust for a digital age. It invites us to consider who should hold the power to write history, and how that history should be preserved.

From a mysterious white paper in 2008 to the sprawling ecosystem of applications today, blockchain has been built block by block, idea by idea, dream by dream. Whether it fulfills its promise or becomes another footnote in the history of technology will depend not on the code alone, but on the values and vision of the people who build and use it.

And so, the chain grows — not just of blocks, but of human stories, linked together in the hope that we can create a record worth trusting, and a future worth sharing.